The real money for fashion is no longer in fashion How going all in on fragrances has made Puig's fortune

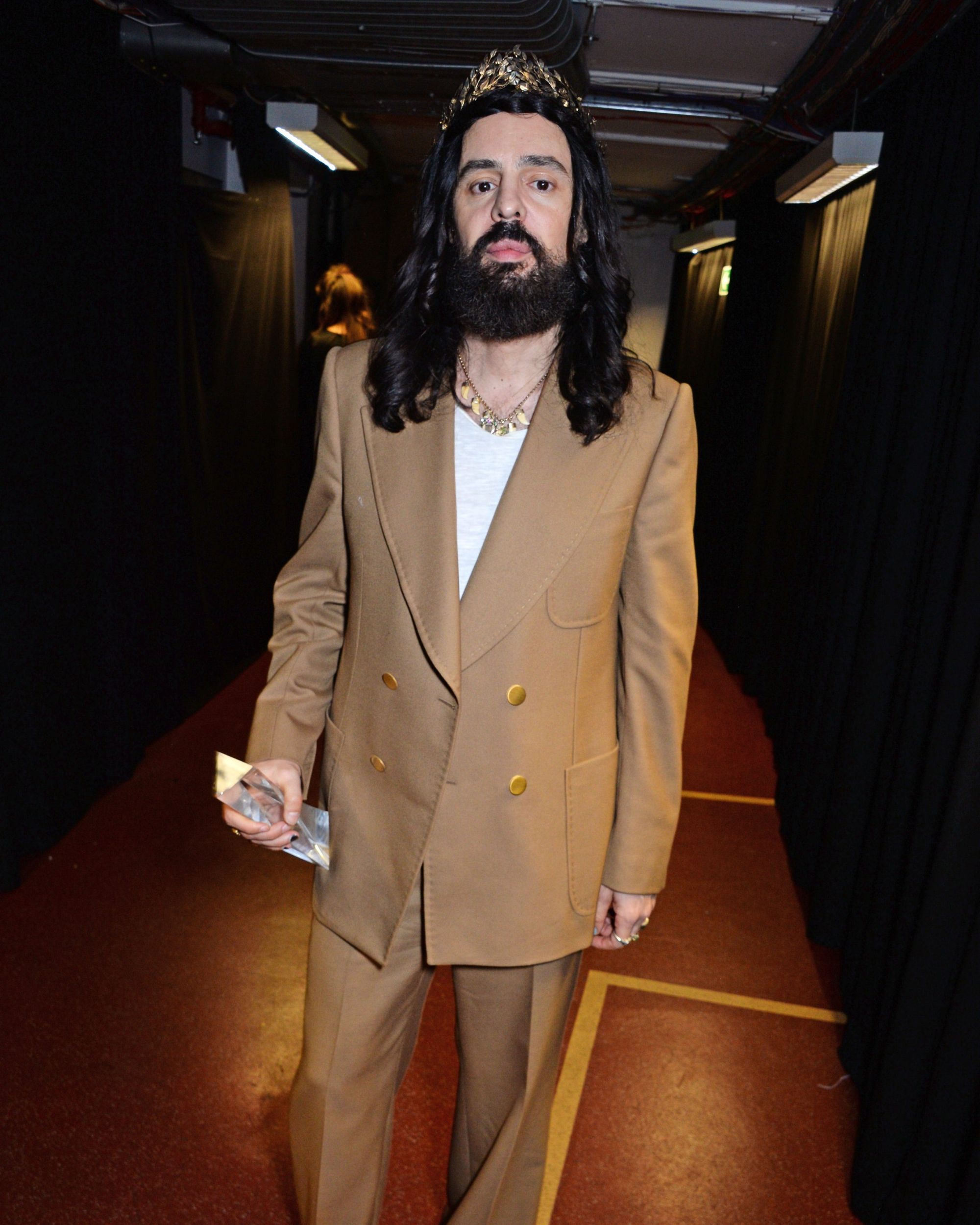

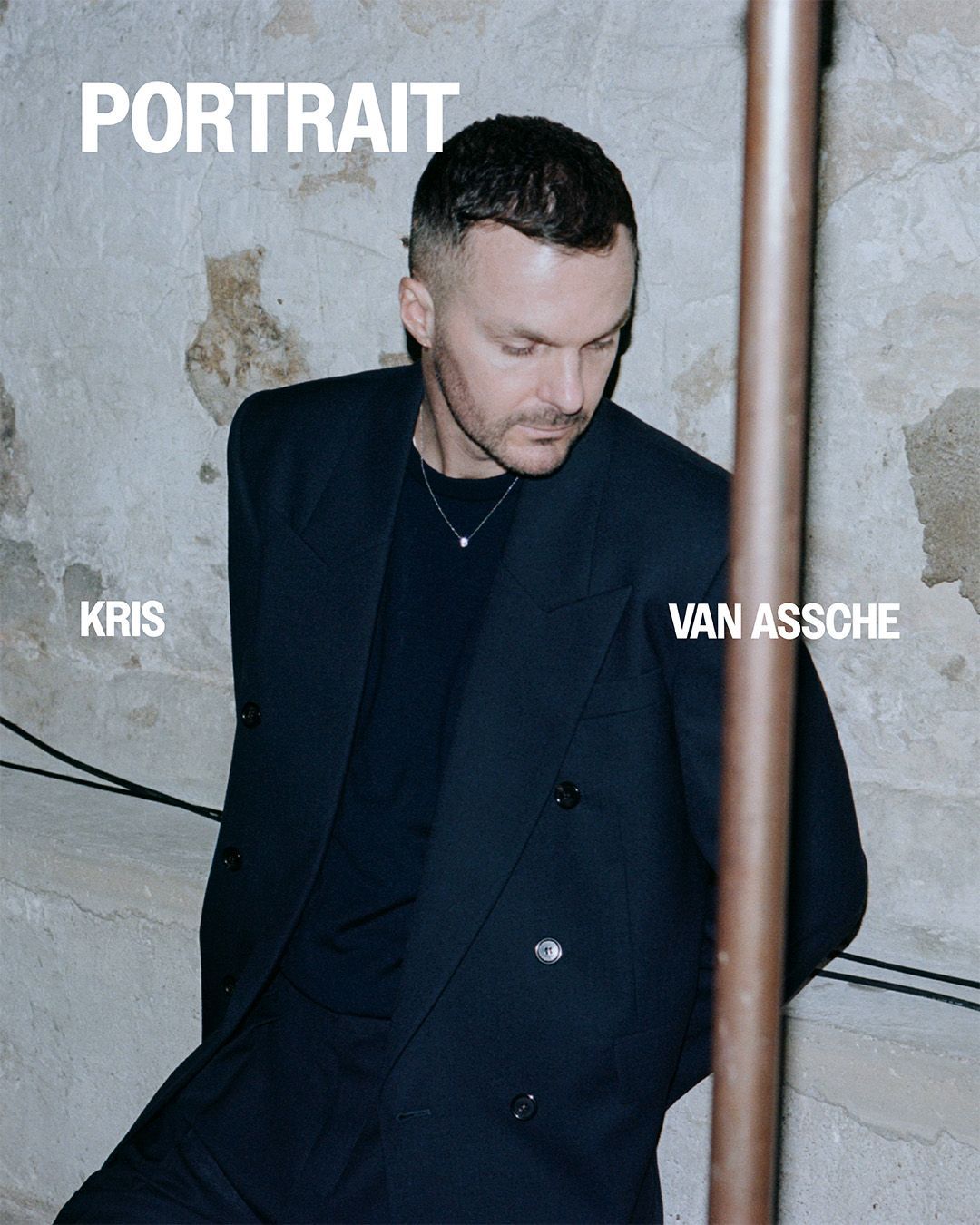

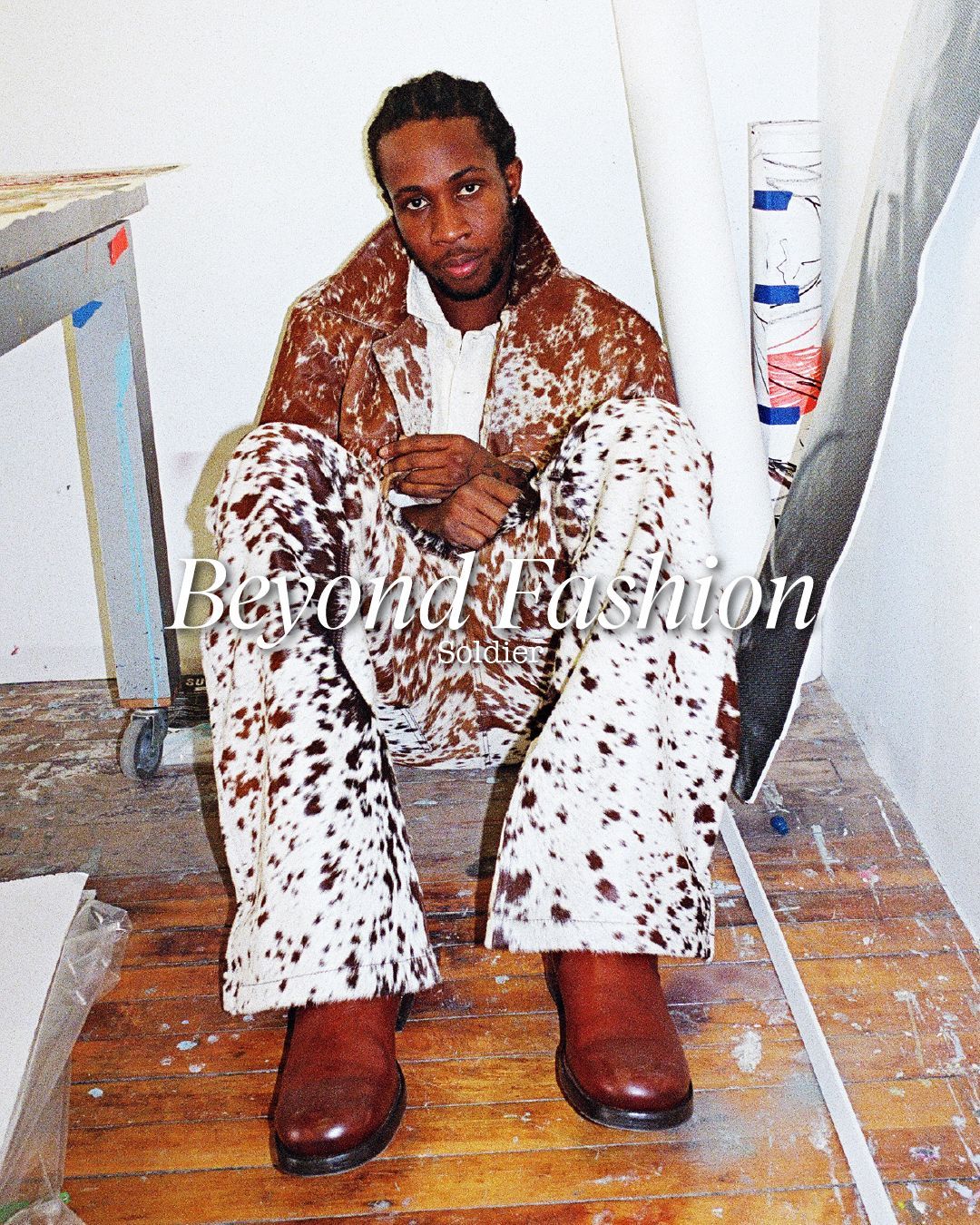

When talking about major fashion groups, Spanish Puig doesn't always come to mind, which indeed primarily deals with perfumes and cosmetics rather than luxury fashion. What are Puig's brands? The most traditional fashion brand in which they are majority shareholders is Dries Van Noten, which launched a line of perfumes and fragrances in 2022; there are also Jean-Paul Gaultier, Rabanne, Nina Ricci, and Carolina Herrera besides brand licenses such as Louboutin and Comme des Garçons, and of course, some of the heavyweights in the beauty and perfume world like Byredo, Charlotte Tilbury, and Penhaligon’s. The list certainly doesn't end here but it can give an idea of how and where the group operates. Now, over the past two years, the group has revitalized its fashion brands, organizing shows (including the famous guest appearances of external designers for Gaultier's Haute Couture), creating collaborations, and hiring young and charismatic creative directors like Harris Reed for Nina Ricci. And it's common knowledge that, even though these brands regularly showcase their collections, the shows at fashion weeks serve to build a brand perception not so much in clothing but in perfumes and beauty. A strategy that works great: in a year like 2023 where luxury spending experienced a significant slowdown, Puig Group exceeded the €4.3 billion threshold in sales, surpassing not only the average growth of the beauty market, estimated around 8 percent, but also consolidating Puig's position as a dominant player in the industry.

President and CEO Marc Puig attributed this extraordinary performance to the company's strategic initiatives, including expanding the portfolio of owned brands, emphasizing prestigious products, and consolidating leadership in niche perfumes and makeup. Net profits for the year reached €465 million, marking a notable 16 percent increase on a like-for-like basis. Other data reported by the group demonstrates a remarkably healthy state: gross operating margin rose to €849 million, a 33% increase over the previous year. All in line with the ambitious three-year plan presented in March 2021 aimed at achieving €3 billion in sales by 2023 (a goal well exceeded) and €4.5 billion in 2025. However, supported by robust growth over the past three years, Puig not only exceeded its 2023 sales target but almost tripled sales two years earlier than expected. Wise financial management also plays a role: from 2021 to now, Puig has maintained a net debt amounting to €1.2 billion at the end of 2023, managing its finances judiciously to maintain a healthy balance sheet and financial stability that many other groups, in their fervent investment and expansion, often tend to lose. A true perfume empire: as of today, Puig holds 11% of the luxury perfume market share worldwide - a segment (technically made up of "perfumes and fashion") that already represented 72% of total sales and saw a 17% increase, driven by Rabanne's 1 Million and Carolina Herrera's Good Girl, along with numerous Gaultier fragrances. Another 18% worth €773 million comes from cosmetics while the fastest-growing segment is skincare with sales soaring to €431 million, up 31%.

@perfumedpriorities Unboxing and reviewing the Dries Van Noten discovery kit! Part 1 #perfumetiktok #perfumetok #driesvannotenperfume #soiemalaquais #lebonmarche #perfumediscoverykit original sound - Hannah

All results that have been a combination of various strategic choices, geographic expansions, retail strategies as well as a partnership with the 37th America's Cup and according to some, even a future stock listing. But they are also results that demonstrate how in the midst of a normalization of luxury spending, which represents not so much a crisis as a "cooling down" of growth in an absurdly saturated market, the principle that perfumes fuel sales is not only valid but has become foundational. For Puig, after all, perfumes are sales and, perhaps somewhat cynically, it makes a lot of sense that when talking about fashion brands, clothes are just the facade of a business whose nature is completely different. And this is also seen on the websites of the brands in question, always evenly divided between fashion and perfumes. It's not a big revelation: already in the '20s and throughout the entire Second World War, Chanel depended on perfume sales so much so that it fought tooth and nail to wrest Parfums Chanel company from the Wertheimer family who now owns the entire brand; the same goes for Parfums Christian Dior established in '47 and becoming one of the strongest muscles behind the brand's sales traction first and then of LVMH. But Puig's success reveals a shift: now perfumes and makeup can support a brand on their own - and perhaps relying less on clothing sales allows shows and collections to operate with relatively greater freedom (think of Gaultier's couture shows, beloved and watched) compared to brands that, to boost sales and position themselves higher and higher, are forced to write ever larger numbers on price tags. Money doesn't stink - it smells great.