Is streaming TV evolving because of advertising? New ways of distributing TV content are emerging

In a short time, Netflix's Basic plan, a cheaper subscription that includes ad breaks, launched last November, has once again revolutionized the streaming market. With about five million subscribers on this formula, Netflix-which is also increasingly similar to traditional TV in terms of content-has found a way to appease the subscription fatigue of users. In fact, unsubscribing has become a much more common practice, due to the overcrowding of streaming platforms - Netflix's initial monopoly was joined by Prime Video, then the offerings became even broader, thanks to the arrival of the likes of MUBI, Disney+, Paramount+, and many others. This variety of platforms has led most users to a selection of services to subscribe to, also based on the proposal of the moment. According to a survey conducted by Deloitte in the United States, in the past six months 44 percent of respondents have canceled at least one subscription «to video-on-demand services.»

@kindergartenthoughts Even though some shows and movies will be missing, I think I’m gonna give the ad version of Netflix a try! I don’t need the convenience of no adds and more shows. Look at Netflix terms and conditions for more details. #netflix #netflixwithads #netflixads #netflixsubscription #netflixplan #netflixplanprices #netflixprices original sound - Lauren Paige

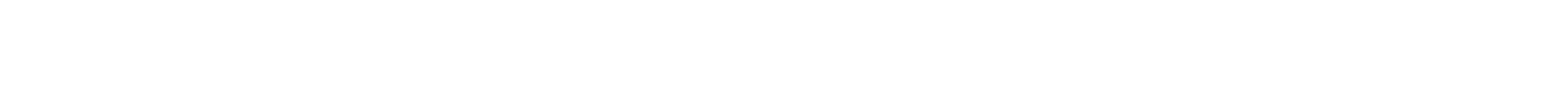

«As much as the streaming war is not yet over, a quiet period is certainly underway, and companies are reviewing their strategies,» wrote The Verge. Among the platforms that are changing their traditional approach to the paid content they offer is Max (until recently called HBO Max), the Warner Bros. Group's streaming service. Discovery, whose Base plan is chosen by 25 percent of its new subscribers. Until now, the streaming war had been fought mainly by ambitious investments in individual productions, so as to secure the most beloved actors and directors, and consequently the interest and attention of the public; the arrival of commercials on this type of service, however, on the one hand, has increased the prices of traditional advertising-free subscriptions, while on the other hand, it has encouraged the spread of new forms of distribution of television content.

In particular, streaming services belonging to the so-called FAST (Free Ad-Supported Streaming TV) category are gaining popularity: content is free with advertising, but it is part of larger schedules with precise thematic channels. This is, for example, the case of Rakuten, founded in Japan but widespread in many European countries, including Italy, whose offer also includes channels dedicated to the main publications of the Condé Nast publishing group, including Glamour, GQ, Vanity Fair, Vogue, and Wired. Samsung, too, with the Samsung TV Plus service preinstalled in every one of its televisions produced after 2016, has embraced the same model: according to a survey conducted by the South Korean multinational itself, the percentage of users who use channels belonging to the FAST category «has increased by 9 percent, while their overall usage has grown by 19 percent.» The value of this market between 2019 and 2022 has grown about twenty-fold, and according to a study by Omdia, a consulting firm specializing in the telecommunications industry, it will be worth $12 billion by 2027.

One startup that has made a name for itself in this area is Telly, which offers users a free television equipped with two screens, one of which - of reduced height compared to the first - is reserved for advertisements, which are played nonstop in parallel with the broadcasts. While a rather special case, Telly does not differ much from the business models of companies that sell both physical devices and advertisements within specific channels, such as Roku and Vizio. The latter in 2021 announced strong growth in advertising-related revenue, which allows it to sell televisions at much more competitive prices. «Like other TV manufacturers, we have viewing data but we also have audience information at the individual household level. By combining the two together, targeting is literally one-to-one,» Telly founder Ilya Pozin explained to the Hollywood Reporter about these new formulas. Many people have criticized the product, however, believing it to be a risk to user privacy-in 2017, the company was forced to pay a $2.2 million fine for collecting data on the behavior habits of eleven million users.