Where does fashion stand in Qatar? From spaces for retail, to spaces for culture

In less than a week, the FIFA World Cup will land in Qatar, marking not only the first World Cup to take place in the Arab countries but also an entire month during which the country will become a magnet for tourist flows from around the world. The luxury industry has certainly not been indifferent to this shift in attention to the country, which in recent weeks has already hosted virtually every notable name in the fashion world during the Fashion Trust Arabia 2022 celebrations and the opening of the Forever Valentino exhibition in Doha. After a diplomatic crisis with other Arab countries that began in 2017 and ended only last year, the emirate is poised to become a new luxury hub and, as told by Business of Fashion, has begun to attract retailers and investors. One of these is Qatar Holdings, a company that already owns Printemps in Paris and Harrods in London, which has opened a Printemps location in Doha while in April the Place Vendôme shopping center also opened its doors to the public along with a luxury hotel attached to it. Also according to BoF, the Mayhoola for Investments group, i.e., the owner of Valentino and Balmain, among others, is receiving funds from the Qatar Investment Authority. These new developments are also being joined by a robust network of luxury mega malls that would seem to be aiming to turn the emirate into a new international shopping hub on the Persian Gulf. Yet doubts exist about this kind of disproportionate growth: when the wave of tourists brought by the World Cup is exhausted, what will become of this vast retail ecosystem?

@placevendomeqatar What’s your favorite brand at Place Vendôme?ما هي علامتك المفضلة في پلاس ڤاندوم؟#PlaceVendômeQatar original sound - placevendomeqatar

The World Cup, as mentioned, will last about a month, bringing an estimated 1.5 million tourists to the country. As the richest country among the Arab countries, Qatar has thus invested heavily at this time by implication that the infrastructure developed for the World Cup will form the logistical basis of a restart for the tourism industry in the emirate. Among the new palaces, restaurants, urban transportation networks, and hotels, nightclubs, and bars (alcohol is prohibited in Qatar only in public, while it is possible to drink in specially licensed bars and hotels), large luxury shopping malls represent one of the spearheads of the tourism offering. Interviewed on the subject by BoF, Patrick Chalhoub, CEO of the group that bears his name and represents the largest retail operator in the Middle East, said that the context of general modernization and infrastructural development that the country is experiencing in the run-up to the World Cup is «the right time to change our penetration strategy in that market». According to Chalhoub, throughout Qatar, local luxury customers are only 3,000 and are the main target of the group's expansion strategies, whereas foreign executives living in the country and foreign professionals are a secondary target. And if some shopping malls, such as the one at Hamad Airport, remain commercially viable, the same local retailers think that Qataris will prefer not to spend in the month when the legion of tourists and visitors flock to the commercial hubs.

Between Villagio Mall, Mall of Qatar, Doha Festival City, Place Vendôme, Galeries Lafayette Doha, and Printemps, in addition to the aforementioned Hamad Airport Mall, the luxury offerings (which also include other malls in addition to those mentioned above) appear disproportionate to demand - especially when the World Cup waters have calmed down. According to many of the businesspeople interviewed by BoF, for example, the widespread belief is that an improved food and beverage proposition could lead to more traffic, especially from local consumers. But even though a study by RedSeer Strategy Consultants predicts that by 2030 tourist traffic in the country will touch six million annually, local retailers are concerned about the spending habits of their fellow citizens, those 3,000 luxury customers mentioned above, who in 2022 preferred to shop during their trips to Europe than at home, and this is because of convenient currency exchange. All these bets and predictions for the future, however, will necessarily have to confront the success of the Word Cup: if the event is successful, the visibility gained by the country will bring new tourist flows and perhaps even new inhabitants-but at the moment Doha still suffers from its proximity to Dubai.

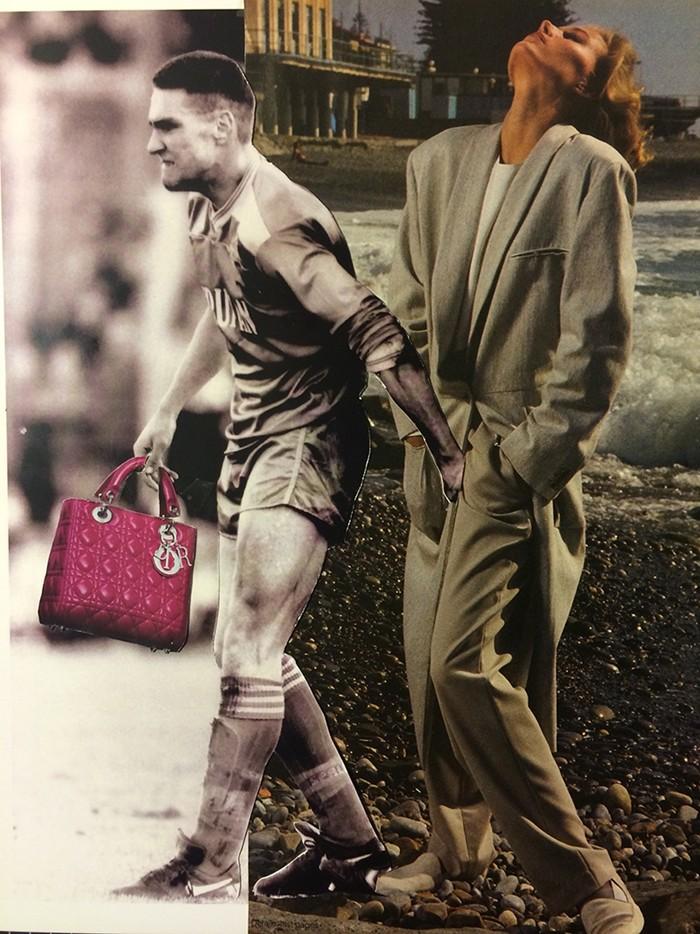

All the fashion gays in Doha Qatar representing the deadly homophobic Qatari government, it must be crack.

— Unlearning and Relearning life (@AdeolaNAderemi) November 6, 2021

I hope the checks and private first-class tickets are worth it.

Another burning factor in Qatar's tourism resurgence is the country's intolerance of homosexuals and the LGBTQ+ community. Only last week Ambassador Khalid Salman ended up amid a public shitstorm after saying that homosexuality is a mental illness on live TV in Germany, closely coinciding with reports by Human Rights Watch and a series of revelations by members of the LGBTQ+ community have highlighted the systemic brutality that police forces employ in enforcing their country's laws. Earlier this month, an account of what happened to a Filipino man in Doha in 2018 also highlighted how police set real traps for community members that frequently result in forced detentions, verbal and physical abuse, and the most serious cases, rape and death sentences. A type of political attitude that is certainly at odds with the adoration that the Arab world would seem to want to pay to fashion and that also creates a climate of distrust that discourages Western tourism flows.