What could change for Italian fashion in 2024? The year begins, and rumors circulate – but will there be more surprises?

According to numerous sources (as well as numerous rumors that, as we know, in Milan always end up in the public square), the landscape of Italian fashion in 2024 could change. Specifically, it could lead to a series of historic brands in our country, more or less independent until now, being swept up by a wave of mergers and acquisitions that has the serious potential to redefine the sector. Already in 2023, the acquisition of Farfetch by the Korean giant Coupang concluded, which wouldn't directly concern Italy, except that Farfetch's portfolio includes various licenses for brands like Off-White, Palm Angels, or Marcelo Burlon, historically linked to the Milanese fashion ecosystem, that are still valid – opening up a range of potential scenarios, launches, relaunches, or even changes in creative direction. But this remains in the realm of speculation: as mentioned, those of the New Guards Group are all licenses, and if their owners decide to change them at the end of the contractual terms, this or that brand could possibly change hands. However, other and perhaps more substantiated rumors have been heard throughout the year and could materialize in the next twelve months.

Here are the main ones.

The Possible Sale of Missoni

In 2018, the Italian investment fund FSI acquired a 41.2% stake in Missoni, injecting 70 million euros into the brand, while the founding family retained control with a majority stake of 58.8%. Recently, as also reported by Reuters, Missoni has sought the advice of Rothschild bankers to explore the possibility of selling the brand, a move that, according to various reports, would be due to the interest expressed by several luxury groups in the brand during the summer. In recent months, the hypothesis had arisen that the group in question was OTB, but today it seems quite unfounded. Other insiders have suggested to Reuters that an industrial partner might be intrigued by Missoni's production and artisanal capabilities. According to sources, the family is contemplating various options, including a complete sale that could follow, in broad terms, the model of Versace that changed hands without altering the position of the original family (and greatly enriching it). In recent months, Livio Proli, Missoni's CEO, had also stated: «We are convinced that, whether the Missoni brand continues on its own or with the resources and synergies of a large group, it must remain very focused on its artisanal specificity,» which evidently represents the brand's main asset.

Etro vs. Arnault?

In 2021, the private equity giant L Catterton (one of the branches of the Arnault empire and LVMH) acquired a majority stake in Etro through a 500 million euro deal. At the end of 2022, Etro boasted sales of 277 million euros, registering a 17% increase compared to the previous year. However, according to Milano Finanza, the company suffered a loss of 23.6 million euros, which WWD mainly attributes to depreciations and extraordinary expenses. Consequently, L Catterton initiated a recapitalization at the end of the year, injecting 15 million euros into the company to facilitate additional investments. However, Luisa Zargani of WWD indicates in the aforementioned article that L Catterton's active role in orchestrating the merger of the watch and jewelry distributor Nuova Publitex with Etro, impacting the balance sheet, has caused friction with the Etro family. The family, holding a minority stake in the brand, expressed dissent over this decision during an extraordinary shareholders' meeting in Milan. The CEO's strategy aims to ensure sustained profitability and liquidity, given the losses in 2022 and the investment for the merger with Nuova Publitex. However, from the minutes, it is read that if the Etro family does not contribute by the end of the year, L Catterton will take responsibility «to exercise the right of pre-emption for the entire amount of the increase in the event of renunciation by the entitled persons or in the event that, at the expiry of the legal term, they have not exercised it.» This revelation implies a potential disagreement within the Etro family regarding the operation or a disagreement between the Etros and L Catterton, setting the stage for a scenario that will likely evolve based on the company's performance.

The Fate of Trussardi

2023 was a challenging year for Trussardi – if anything of the company is left. Trussardi is currently controlled by QuattroR, which in 2019 acquired about 60% through a Newco participated 70% by QuattroR and 30% by Tommaso Trussardi, as explained by Il Sole 24Ore. The Newco controls 86% of the Finos holding, the sole shareholder of Trussardi S.p.A. The restructuring was handled by the Bergamo-based company 3X Capital led by Angelo Rodolfi. In March 2023, the company had debts exceeding 50 million euros and a loss of 20 million euros on a total budget of 65 million. The extrajudicial procedure was adopted as a "protective measure" to settle debts while seeking a potential buyer. Alternative scenarios include closure with a preventive arrangement, a simplified liquidating arrangement without a vote of creditors, or a judicial liquidation. Despite expressions of interest from potential buyers, no transactions have been concluded. In an attempt to reduce costs, the company closed stores and foreign branches. Trs Evolution, the operating company with around 200 employees, activated extraordinary wage supplementation, but it seems to be limited to employees at the administrative headquarters in Milan and has expired on New Year's Eve. Remember that CEO Sebastian Suhl and creative directors Serhat Işık and Benjamin A. Huseby left Trussardi last year, stating later that they hadn't even been paid or dismissed. In every respect, Trussardi is a ghost house: technically, no one lives there, but figures can be seen occasionally looking out of the windows. According to Milano Finanza, the funds ChimHaeres and Growcapital global could be considering taking control of specific business segments following the crisis that began in March, which saw the Board of Directors dissolve, the CEO leave, and the designers return to their Berlin without pay but also without a contract split.

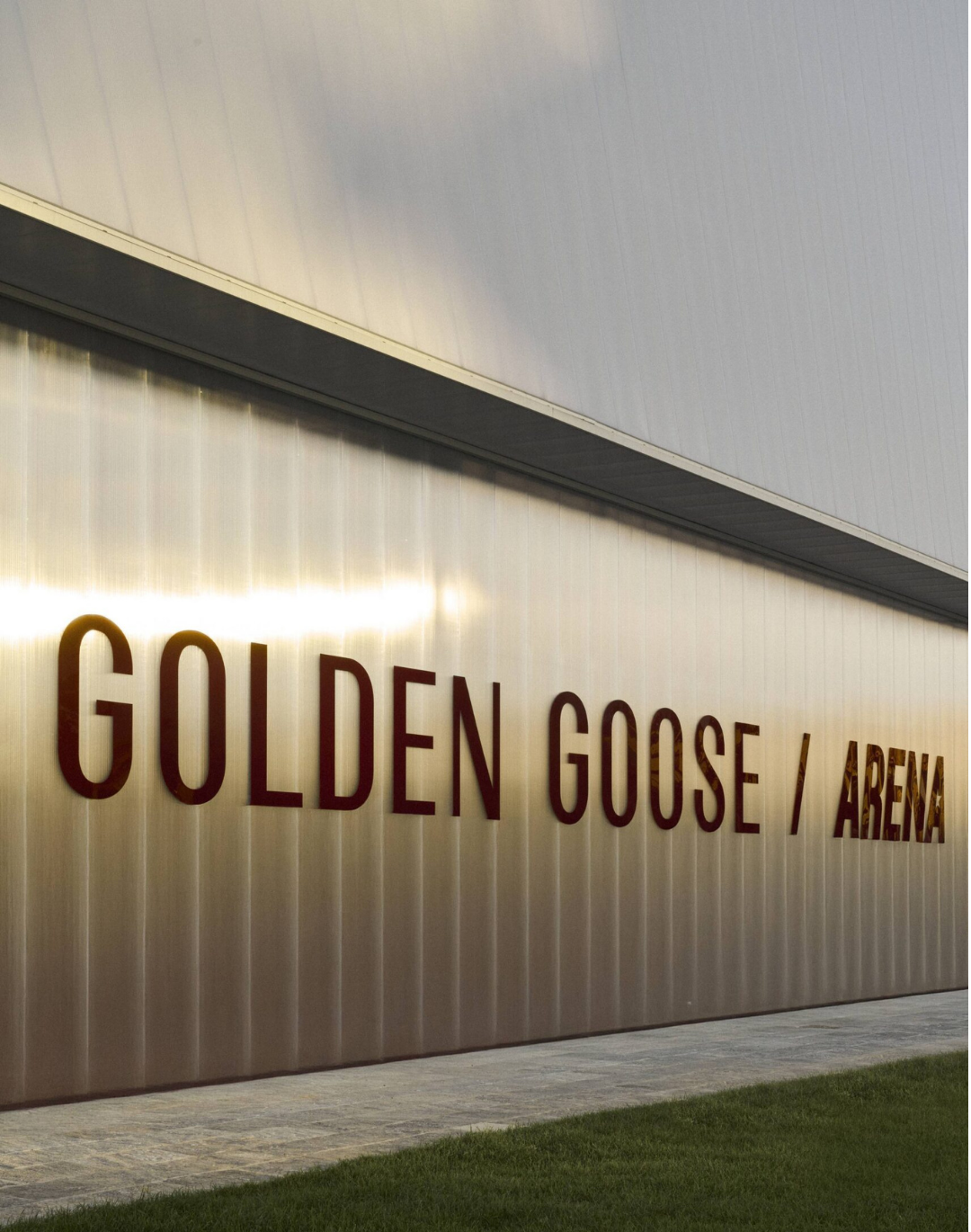

Golden Goose Going Public?

In 2020, Golden Goose underwent a change of ownership when the private equity fund Permira acquired it from the Carlyle Europe Buyout fund for 1.28 billion euros. Led by CEO Silvio Campara, Golden Goose has achieved considerable success, especially with its Superstar sneaker. The financial performance of the company reflects a positive trend, with revenues of 421 million euros in the nine months ending on September 30, registering a 19% increase compared to the same period in 2022. Compared to 2021, sales experienced a significant surge of 60%. Importantly, profitability has continued to grow, as evidenced by the EBITDA margin, which reached 34.8% in the first nine months of 2023. These are very important results, especially considering the relatively young age of the brand – and that's why, even if not substantiated, many online sources discuss a potential future listing of the brand. According to WWD, in fact, Golden Goose shareholders intend to expand the brand's scope, broaden the product offering beyond shoes, position the brand even higher, and, above all, avoid surprise devaluations as occurred last year.